Investing in Shares for Maximum Returns-Online Course

When I was 17 I did a B.Comm degree in University College Dublin. My time in UCD sparked a lifelong passion in shares and investing in companies. Since then I have started many businesses and now practice as a solicitor in my own solicitor’s practice. But I have been investing in stocks and shares since 1987.

In this online course-delivered by video-I share what I have learned along the way to make share investing profitable, good fun and providing tremendous medium to long term returns.

Videos include:

- Advantages of the Small Investor [4:25]

- Risk – is share investment right for you? [3:25]

- Your personal circumstances [1:42]

- Timing the market – the wrong question [2:08]

- Picking winners – how to pick a good share [3:01]

- Research and researching the company [4:00]

- Understanding the company’s business [4:36]

- Shares to avoid [0:49]

- The price/earnings ratio – the critical role of earnings [3:26]

- What’s the company’s story? [2:15]

- Analysing the company – taking a closer look [5:05]

- Share analysis – summary and recap [1:48]

- Your portfolio [5:11]

- Stupid comments about shares you need to ignore [2:02]

- When should you sell a share?

- Recap

- How I choose shares now

Bonus videos

Bonus video #1-Davy Select share platform review [15:01]

Bonus video #2-DEGIRO share platform introduction [6:18]

Bonus video #3-How to buy shares on the DEGIRO platform [6:50]

Bonus video #4-Selling SNAPCHAT shares on DEGIRO [4:20]

Bonus video #5-Taxation essentials [4:45]

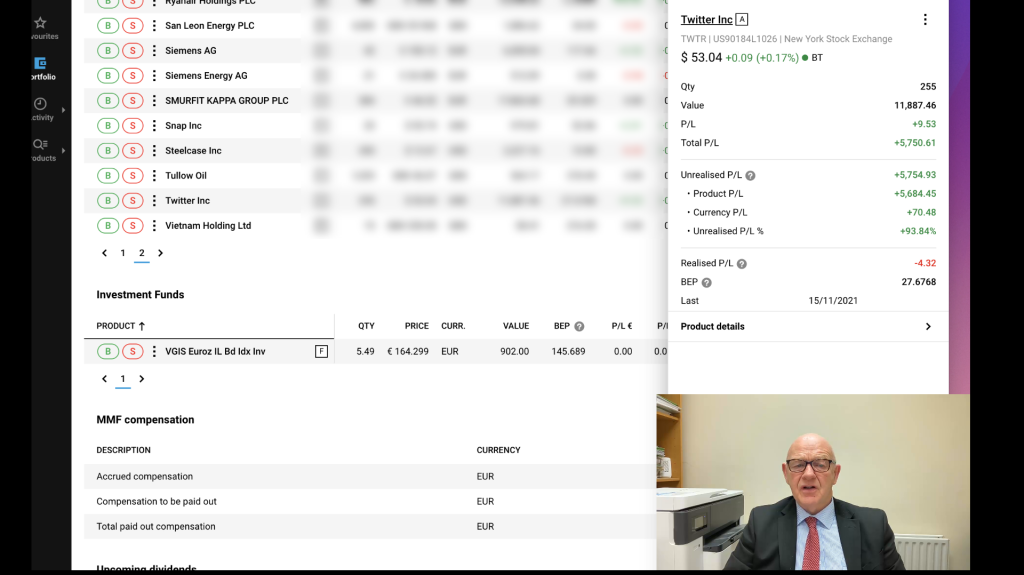

Bonus video #6-Selling my Twitter shares at a 93.8% profit

Bonus video #7 – My UK shares portfolio

Online Course Relaunch, February 2025

Money back guarantee

If you are not completely satisfied with my course I offer a 100%, no questions asked money back guarantee.

Warning

The value of any investment may go down as well as up and you may lose some or all of the money you invest. Past performance is not a reliable guide to future performance.

Execution-Only, which is the strategy I adopt regarding my share purchases, is not for everyone. You should ensure that you fully understand any investment and the associated risks before making a decision to invest.

This course does not constitute investment advice as it does not take into account the investment objectives, knowledge and experience or financial situation of any particular person or persons. Prospective investors are advised to make their own assessment of the information contained herein and obtain professional advice suitable to their own individual circumstances.

This course is an education product, with an objective of giving you the knowledge and information to make your own informed decisions regarding shares and property. That informed decision, once you have taken this course, may be to engage further professional advice from an investment expert, tax expert, accountant, solicitor, or other professional with the necessary qualifications.

Click here to enrol in the online shares course

February 2025

The Course #2 below will be relaunched in the near future. But it is not available at the moment (February 2025)

Course #2-Property and shares investing course

Have you ever wanted to invest in shares but you were not sure what was involved? Did the lack of knowledge prevent you from getting started with building your own small shares portfolio?

Or perhaps you have an interest in property investment-bricks and mortar?

I have created an online course which aims to help you. It is an online investment course divided into two parts:

- Investment in shares

- Investment in property

I have drawn upon my own experience and training to create a course comprising at least 35 videos setting out what I have learned since I bought my first property 35 years ago in 1986.

Since then I have been investing in property and shares and have done well.

More importantly, however, I have learned the fundamentals of investing in shares and property.

Not just from studying books or reading up about the theory of investment but from investing my own (and the bank’s) money in many different properties and ventures over the 3.5 decades.

Some have succeeded, some have disappointed.

And the property crash that followed the Celtic Tiger property boom was an expensive, memorable lesson.

My online course will give you the lessons from what I have learned and will give you the tools to look after your own investments.

Firstly, you need to decide if shares or property are right for you. I explain the factors you need to consider, especially your own circumstances and your psyhological outlook.

What you will learn (shares)

- Advantages of the Small Investor [4:25]

2. Risk – is share investment right for you? [3:25]

3. Your personal circumstances [1:42]

4. Timing the market – the wrong question [2:08]

5. Picking winners – how to pick a good share [3:01]

6. Research and researching the company [4:00]

7. Understanding the company’s business [4:36]

8. Shares to avoid [0:49]

9. The price/earnings ratio – the critical role of earnings [3:26]

10. What’s the company’s story? [2:15]

11. Analysing the company – taking a closer look [5:05]

12. Share analysis – summary and recap [1:48]

13. Your portfolio [5:11]

14. Stupid comments about shares you need to ignore [2:02]

15. Recap [1:51]

Bonus video #1-Davy Select share platform review [15:01]

Bonus video #2-DEGIRO share platform introduction [6:18]

Bonus video #3-How to buy shares on the DEGIRO platform [6:50]

Bonus video #4-Selling SNAPCHAT shares on DEGIRO [4:20]

Bonus video #5-Taxation essentials [4:45]

Bonus – My share portfolio

This course is not going to teach you how to get rich quick. If that’s what you are looking for you will have to continue looking.

And I make no promises about your success or the type of returns, if any, you will receive.

But you will acquire the knowledge needed to allow you to invest in shares and property with confidence.

You will be able to watch the videos and take notes at your own pace. And study the material in your own time and at a time that suits you and fits into your lifestyle.

At the end of it you will have learned how to buy your own shares and build your own portfolio, what to look for, what to avoid, how to research companies and analyse shares, and what sources of information/research you can rely on.

Click here to head over to Teachable.com to learn more and enrol.

Property

I bought my first property in Dublin in 1986 when I was 23.

I have bought, sold, developed, built many properties over the last 35 years. Residential, commercial, retail, greenfield sites, and so on.

The photographs above show some of the property deals I have been personally involved in over the years. My hands on experience, together with my professional training as a solicitor, allows me to give you a unique perspective when it comes to property investment in Ireland.

This course contains what I have learned over 35 years of investment in property and shares. I believe my experience has value and can help you avoid certain mistakes that I have made or encounter an an all too frequent basis.

Here are some of the things you will learn in the property section of the course:

What you will learn (property)

1. Shares or property? [10:59]

2. Building a buy to let property portfolio – the dream versus the reality [7:34]

3. Buy to let investment is a simple game [5:51]

4. Capital Gains Tax [11:20]

5. Commercial property investment – 3 factors to consider [7:06]

6. Finding a no brainer investment is possible [3:28]

7. Property investment in Ireland – FAQ [11:18]

8. VAT on property [4:47]

9. 2 essentials for successful property investment [4:41]

10. 10 tips for successful negotiations [15:43]

11. Buying property for cash – the three big advantages [6:23]

12. Why you need a structural survey [10:51]

13. Costs [4:00]

COURSE CURRICULUM

Here is the complete course curriculum, with the length of each video in brackets.

Introduction

Welcome [5:07]

Investing in Shares

1. Advantages of the Small Investor [4:25]

2. Risk – is share investment right for you? [3:25]

3. Your personal circumstances [1:42]

4. Timing the market – the wrong question [2:08]

5. Picking winners – how to pick a good share [3:01]

6. Research and researching the company [4:00]

7. Understanding the company’s business [4:36]

8. Shares to avoid [0:49]

9. The price/earnings ratio – the critical role of earnings [3:26]

10. What’s the company’s story? [2:15]

11. Analysing the company – taking a closer look [5:05]

12. Share analysis – summary and recap [1:48]

13. Your portfolio [5:11]

14. Stupid comments about shares you need to ignore [2:02]

15. Recap [1:51]

Bonus video #1-Davy Select share platform review [15:01]

Bonus video #2-DEGIRO share platform introduction [6:18]

Bonus video #3-How to buy shares on the DEGIRO platform [6:50]

Bonus video #4-Selling SNAPCHAT shares on DEGIRO [4:20]

Bonus video #5-Taxation essentials [4:45]

Bonus – My share portfolio

Investing in Property

1. Shares or property [10:59]

2. Building a buy to let property portfolio – the dream versus the reality [7:34]

3. Buy to let investment is a simple game [5:51]

4. Capital Gains Tax [11:20]

5. Commercial property investment – 3 factors to consider [7:06]

6. Finding a no brainer investment is possible [3:28]

7. Property investment in Ireland – FAQ [11:18]

8. VAT on property [4:47]

9. 2 essentials for successful property investment [4:41]

10. 10 tips for successful negotiations [15:43]

11. Buying property for cash – the three big advantages [6:23]

12. Why you need a structural survey [10:51]

13. Costs [4:00]

See below for the full course curriculum.

Course curriculum

Who this course is not for

This course is not for you if you want to get rich quick or you are not prepared to put in the required study to pursue successful investments in shares or property. It’s not rocket science, it is easier than you might imagine.

But you must take it seriously and learn the lessons set out in the course.

There are many other courses where wild, inaccurate claims about how much money you will make are made. This makes no such claims. In fact, regarding claims or warranties:

Warning

The value of any investment may go down as well as up and you may lose some or all of the money you invest. Past performance is not a reliable guide to future performance.

Execution-Only, which is the strategy I adopt regarding my share purchases, is not for everyone. You should ensure that you fully understand any investment and the associated risks before making a decision to invest.

This course does not constitute investment advice as it does not take into account the investment objectives, knowledge and experience or financial situation of any particular person or persons. Prospective investors are advised to make their own assessment of the information contained herein and obtain professional advice suitable to their own individual circumstances.

This course is an education product, with an objective of giving you the knowledge and information to make your own informed decisions regarding shares and property. That informed decision, once you have taken this course, may be to engage further professional advice from an investment expert, tax experte, accountant, solicitor, or other professional with the necessary qualifications.

Relaunch

This course is not available in February 2025 but will be relaunched in the near future.